New Guidance on the Alternative Fuel Vehicle Refueling Property Credit: What You Need to Know

The Department of Treasury and the IRS have issued new proposed regulations providing guidance for the Alternative Fuel Vehicle Refueling Property Credit, a key update following the passage of the Inflation Reduction Act. This credit supports taxpayers investing in alternative fuel vehicle refueling infrastructure, reflecting a significant opportunity for both individuals and businesses.

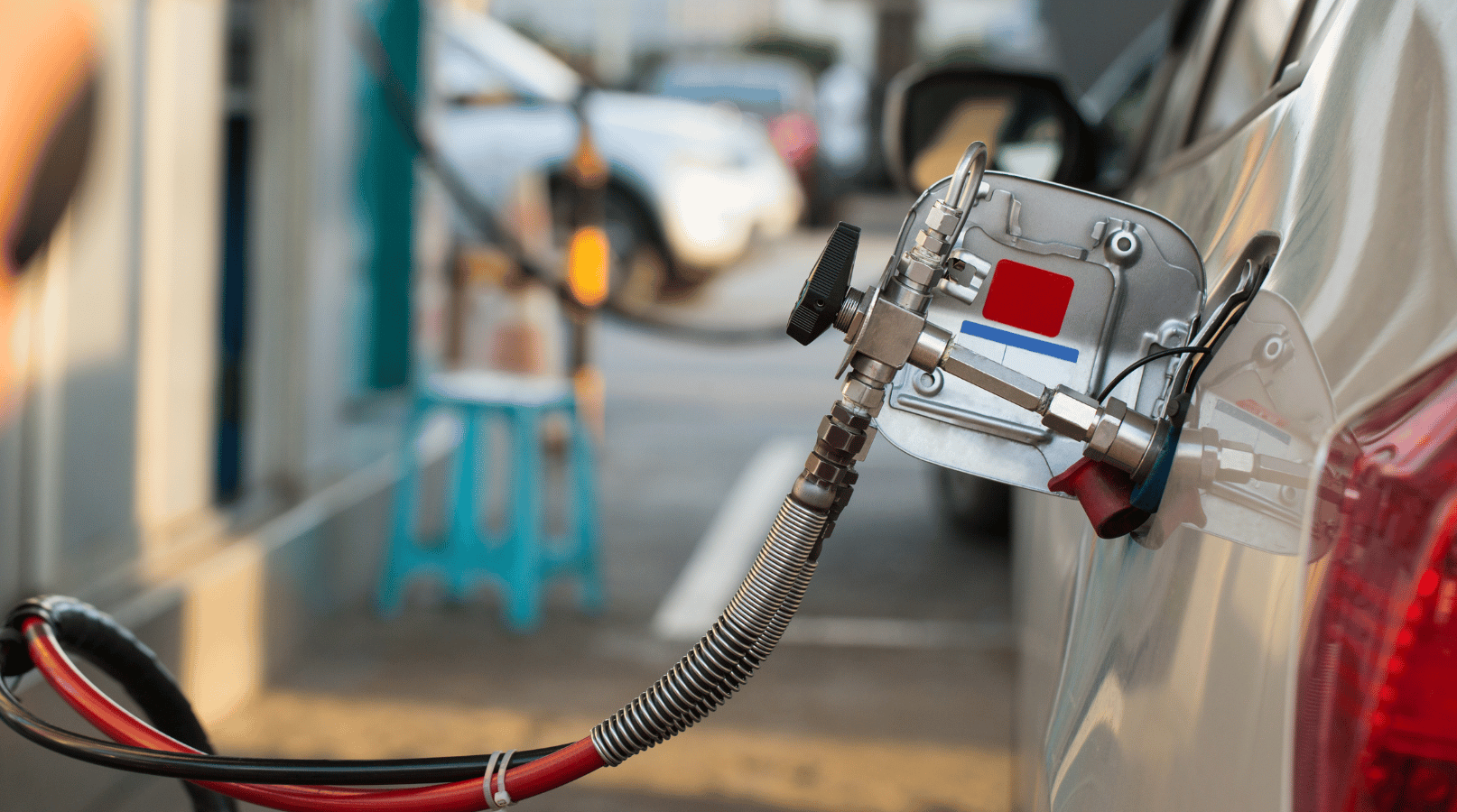

What is Alternative Fuel?

Alternative fuel includes cleaner, more sustainable energy sources such as electricity, hydrogen, natural gas, and biofuels. These fuels help reduce reliance on traditional fossil fuels and lower carbon emissions, contributing to a greener future.

What’s New?

The updated credit applies to property placed in service after December 31, 2022, and before January 1, 2033. For non-depreciable property, the credit is set at 30% of the cost, while depreciable property can qualify for a 6% credit, which can increase to 30% if prevailing wage and apprenticeship requirements are met. The credit is capped at $1,000 for non-depreciable property and $100,000 for depreciable property.

Location Matters

To qualify for the credit, the property must be in an eligible census tract. These tracts are defined as low-income communities or areas that are not urbanized. Specific guidelines for identifying eligible tracts are outlined in the proposed regulations, with the IRS providing updated mapping tools for identifying eligible locations using an 11-digit census tract GEOID.

Understanding the Details

In addition to clarifying what constitutes an “item” of qualified property, the new guidance outlines how to calculate the credit, address dual-use property, and handle special rules, including basis reduction, recapture, and credit apportionment between business and personal use.

The IRS has also updated the mapping tools for eligible census tracts and extended the time period for certain rules originally outlined in Notice 2024-20, now modified by Notice 2024-64.

Stay Ahead with Toro Taxes

Navigating tax credits like this one can provide significant savings, but it can also be complex. That’s where the experts at Toro Taxes come in. We stay up to date with the latest changes in tax law, ensuring that your business maximizes its benefits.

Want to offer the same level of expertise and service to your community? Consider owning a Toro Taxes franchise, where you’ll receive comprehensive support, cutting-edge software, and marketing resources year-round. Join the Toro Taxes family and be part of the largest Latin American tax preparation franchise in the U.S. Learn more about this exciting opportunity by visiting Tax Service Franchise (torotaxesfranchise.com) or calling 800-867-6829 EXT 202.

Cambiar idioma

Cambiar idioma